SILICON LABORATORIES (SLAB)·Q4 2026 Earnings Summary

Silicon Labs Beats Q4, Gets Acquired by Texas Instruments for $7.5B

February 4, 2026 · by Fintool AI Agent

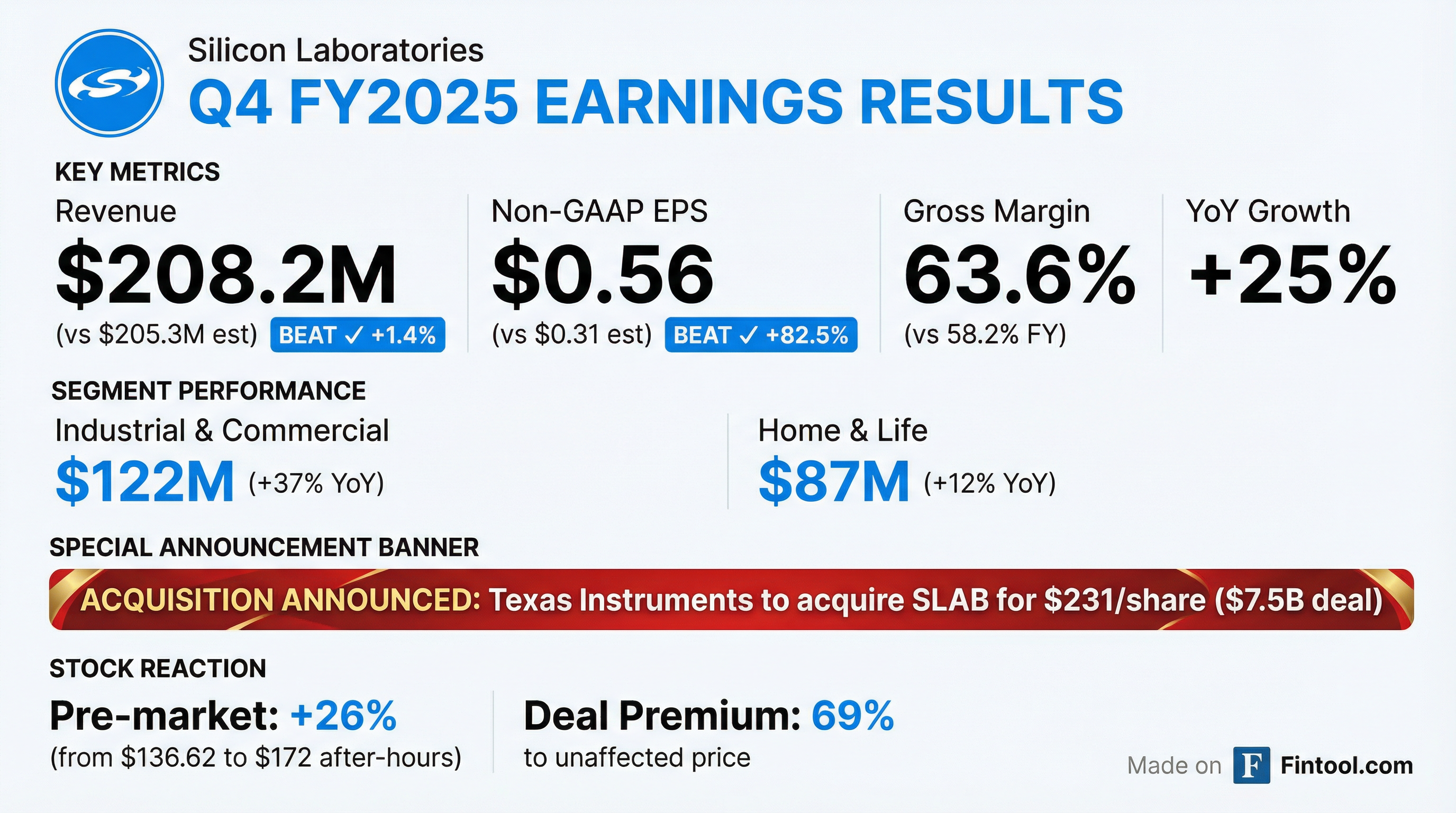

Silicon Laboratories (NASDAQ: SLAB) delivered strong Q4 FY2025 results, beating both revenue and EPS estimates while simultaneously announcing it will be acquired by Texas Instruments (TXN) for $231 per share in a $7.5 billion all-cash transaction. The acquisition marks the end of Silicon Labs as an independent company but validates its strategic position in embedded wireless connectivity.

Did Silicon Labs Beat Earnings?

Yes — Silicon Labs beat on both revenue and EPS.

Silicon Labs delivered revenue of $208.2 million, up 25% year-over-year and above the $205.3 million consensus. Non-GAAP EPS of $0.56 crushed the Street's $0.31 estimate by over 80%, driven by gross margin expansion and operating leverage.

8-Quarter Beat/Miss History:

Silicon Labs has now beaten or matched estimates for 8 consecutive quarters, demonstrating consistent execution through the semiconductor cycle recovery.*

What Happened to the Stock?

Stock soared 26%+ after-hours on the acquisition announcement.

The after-hours surge reflects the massive premium Texas Instruments is paying. At $231/share, the deal values Silicon Labs at approximately $7.5 billion enterprise value, representing a 69% premium to the unaffected stock price.

What Is the Texas Instruments Acquisition?

Texas Instruments announced a definitive agreement to acquire Silicon Labs for $231.00 per share in an all-cash transaction. Key deal terms:

- Purchase Price: $231.00/share (all cash)

- Enterprise Value: ~$7.5 billion

- Premium: 69% to last unaffected price

- Expected Close: First half of 2027

- Expected Synergies: $450 million annually within 3 years

Strategic Rationale:

- Combines Silicon Labs' embedded wireless connectivity portfolio with TI's analog and embedded processing capabilities

- TI's internally-owned manufacturing provides "dependable supply worldwide"

- Creates a "global leader in embedded wireless connectivity solutions"

CEO Matt Johnson stated: "The Silicon Labs team completed fiscal 2025 with continued strong execution, delivering an impressive year-over-year revenue growth of 34%."

TI CEO Haviv Ilan added: "Silicon Labs' leading embedded wireless connectivity portfolio enhances our technology and IP, enabling greater scale and allowing us to better serve our customers."

Due to the pending acquisition, Silicon Labs has cancelled its earnings call and suspended forward guidance.

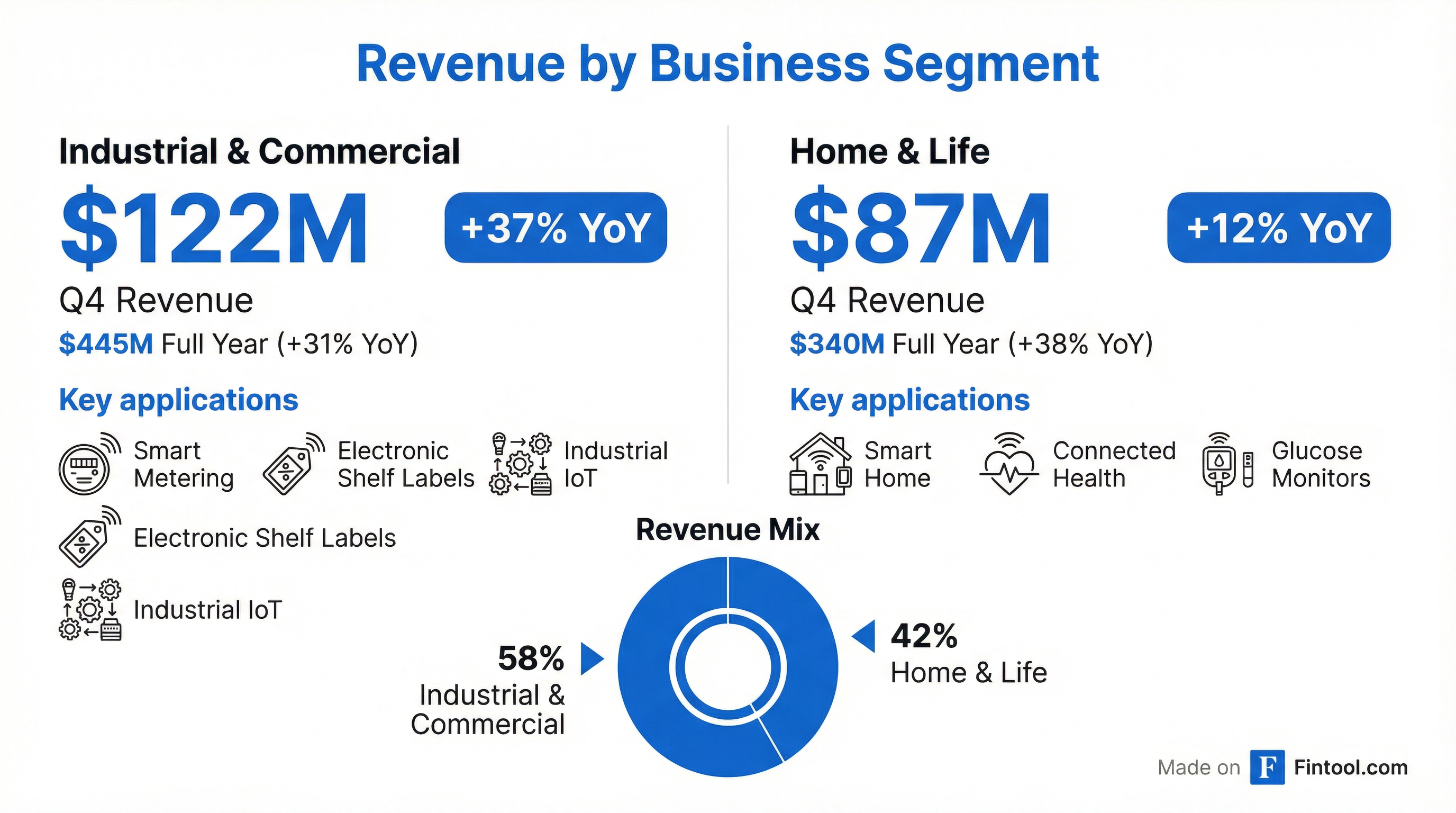

How Did Business Segments Perform?

Industrial & Commercial delivered exceptional growth:

Home & Life showed solid momentum:

Key growth drivers per prior management commentary:

- Electronic shelf label deployments (Industrial)

- Smart metering rollouts globally (Industrial)

- Connected health/glucose monitors with 60+ customers engaged (Home & Life)

- Smart home applications

What Changed From Last Quarter?

Significant improvements across all metrics:

The standout change was the gross margin expansion of nearly 600 basis points sequentially, driven by:

- Favorable mix from long-tail channel sales

- Industrial application strength

- Distribution channel optimization (now ~69% of revenue)

Full Year 2025 Summary

Silicon Labs completed a remarkable turnaround in FY2025, swinging from significant non-GAAP operating losses to profitability while growing revenue 34% year-over-year. The company attributed outperformance to "new customer design ramps rather than on a reliance of robust end market demand."

Balance Sheet Strength

Silicon Labs enters the acquisition with a clean balance sheet — zero debt, $444 million in liquidity, and manageable inventory levels. Operating cash flow for FY2025 was $96 million, a significant improvement from the cash burn in FY2024.

What's Next?

For existing shareholders:

- The $231/share acquisition price offers a substantial premium

- Deal expected to close H1 2027, subject to regulatory approvals

- No forward guidance will be provided due to pending acquisition

Key risks to deal completion:

- Regulatory approval (global antitrust review)

- Customary closing conditions

- ~12-18 month timeline to close

Data sourced from Silicon Labs 8-K filed February 4, 2026, company press releases, and S&P Global estimates.